- ENTRYINDIA EXCHANGE RATES HOW TO

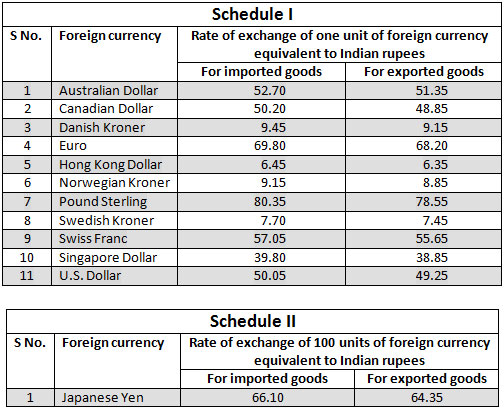

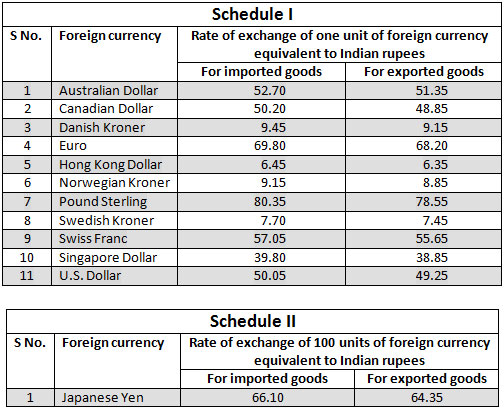

- ENTRYINDIA EXCHANGE RATES FULL

We have a State of Art infrastructure to help us cater to your needs better and the best security measures possible. We make sure to handle your data carefully and confidentially. If you have clarifications and budget constraints, it can all be communicated with these helplines. The internet is a vast space, and to make your job easier, we have a team of specialists on board, part of their service, helping you build trust in them. The data of each company is a prized asset as it withholds information and the valued blueprint of the business, so one must choose how they use their data carefully. Why eDataIndia is #1 Company For Data Entry in India This conversion of knowledge is critical and needs high precise skills.

The data entry can be transcribed from any of the desired formats, including spreadsheets, sequenced numbers, documents, and even names and addresses. These experts take the given information and, using specific and specialized software, enter it.

ENTRYINDIA EXCHANGE RATES HOW TO

Entering specific data into electronic devices is usually done by experts who understand how to handle the data you need.

In this day and age, most growth and technological advancement happen through the careful accumulation and usage of data.

ENTRYINDIA EXCHANGE RATES FULL

Hire Dedicated Full Time Employees Team. One of the best examples of this is Zimbabwe. It is used generally when one uses foreign currency as a national currency. This term is not only correlated to US dollars. Dollarizationĭollarization is a term used when the citizens of a country use foreign currency in relation to their own currency. This fluctuation happens around the central rate. When the rates are pegged at horizontal bands than the band is allowed to fluctuate bigger than 1% although in a fixed rate. Both of these follow certain economic indicators.Ĭrawling pegs are the rate that is in itself fixed. So, it is done in a controlled way or at a preannounced rate. Pegged floats are also considered as crawling bands.Ĭrawling band is the rate at which it is allowable to fluctuate around a central value in a band. They are adjusted either periodically or fixed. Pegged float – These types of currencies are pegged against some value or bands. These regimes are many times managed float or dirty float. Mostly used yen, dollar, Euro, and British pound are the different types of currencies that fall under this category.Īlso, in this case, central banks of the respective countries intervene frequently in order to avoid deprecation or appreciation. The most common regime today that is adopted in most countries are floating exchange rates. Also, they have very small bands which are less than 1%. The countries falling under this have abandoned their own currency in favor of other country’s currency. Also, in case of a different currency, there is a currency board arrangement where it is backed by the domestic currency against one to one foreign reserves. The rates that are directly convertible towards other currencies are called fixed rate. Types of Exchange Rate Fixed Exchange Rate This type of currency is tied up with other currencies and is mostly used for euro or US dollar and another bunch of currencies. There is a third one which is known as the fixed exchange rate. Also, there is pegged currency, where the central bank keeps the rate from differentiating too much. In this, the movements in the currency are dictated by the market. The basic type of exchange rate is called a floating exchange rate. Furthermore, these two are closely related to each other on many factors. Here, the only difference is the price that you use to buy that currency.Īlso, exchange currency is very closely related to monetary policies. Thus, it is like the price that you pay for an asset.

Exchange RateĪn exchange rate is a right way through which an authority manages their own currency with respect to other currencies. Because you require ‘local currency’ for purchasing and other activities.

In other words, the value of other country’s currency when compared with our own is the exchange rate. The rate at which the currency is exchanged for another currency is known as an exchange currency.

0 kommentar(er)

0 kommentar(er)